Development environment: favorable policies continue to be introduced to promote industry development

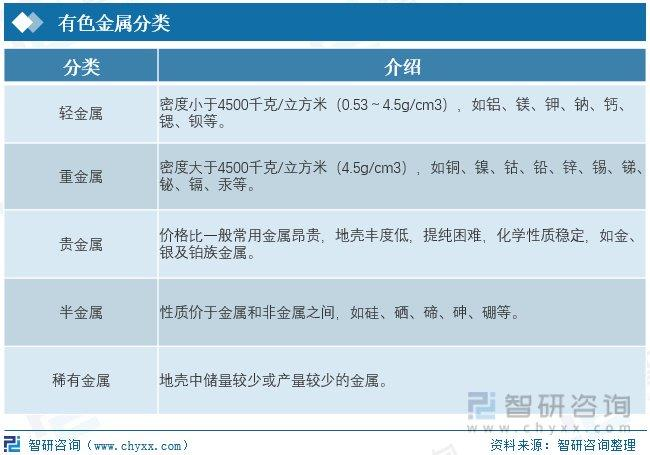

All metals except for iron, chromium, and manganese are called non-ferrous metals. Nonferrous metals can be divided into light metals, heavy metals, precious metals, semimetals, and rare metals. The ten commonly used non-ferrous metals are copper, aluminum, lead, zinc, nickel, tin, antimony, mercury, magnesium, and titanium. Nonferrous metals are the fundamental materials for the development of the national economy, and a large part of industries such as aerospace, automotive, mechanical engineering, energy, telecommunications, construction, and consumer electronics are based on the production of non-ferrous metal materials. With the rapid development of modern chemical engineering, agriculture, and science and technology, non-ferrous metals are becoming increasingly important for human development. They are not only important strategic materials and means of production in the world, but also irreplaceable materials in human life.

Development environment: favorable policies continue to be introduced to promote industry development

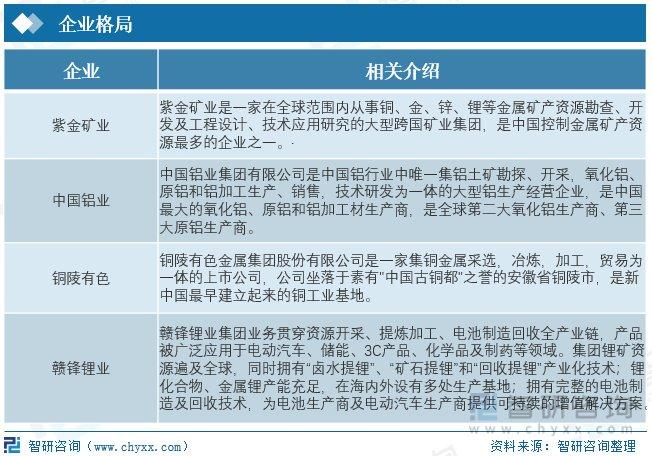

The upstream of the non-ferrous metal industry chain is mainly the mining of mineral resources. The main enterprises that mine non-ferrous metals include Zijin Mining, Aluminum Corporation of China, Tongling Nonferrous Metals, Ganfeng Lithium Industry, etc. The midstream of the industry chain is mainly the smelting and processing of non-ferrous metals. Currently, China's smelting and processing end has a high degree of integration, and the main representative enterprises include MCC Group, Minfa Aluminum Industry, Mingtai Aluminum Industry, Xinjiang Zhonghe, etc. The downstream of the industry chain is the construction of infrastructure, machinery manufacturing, etc. The main representative enterprises include China FAW, Shanghai Volkswagen, Sany Heavy Industry, etc.

In order to achieve stable growth in the non-ferrous metal industry, the Chinese government has issued a series of policies and development plans. In August 2023, the Ministry of Industry and Information Technology released the "Work Plan for Stable Growth of Nonferrous Metals Industry", which mentioned that the development goal of China's non-ferrous metals industry from 2023 to 2024 is to maintain stable growth in the production of major products such as copper and aluminum, with an average annual growth rate of about 5% for ten types of non-ferrous metals, and to achieve a dynamic balance between supply and demand. Operating revenue continues to grow, green and intelligent transformation and upgrading are accelerating, and the annual average energy consumption per unit of copper, lead and other smelting products is decreasing by more than 2%. Strive to increase the added value of the non-ferrous metal industry by about 5.5% year-on-year in 2023, and by more than 5.5% in 2024. In November 2022, the National Development and Reform Commission proposed in the "Implementation Plan for Carbon Peaking in the Nonferrous Metals Industry" to promote the high-quality development of the machinery and equipment industry, the safe, green and efficient development of the petrochemical industry, and the upgrading and transformation of old agricultural machinery, engineering machinery and old ships. In October 2022, the National Development and Reform Commission emphasized the application of high-tech and new materials in the field of non-ferrous metals in the "Catalogue of Industries Encouraging Foreign Investment (2022 Edition)". In March 2021, the National Development and Reform Commission proposed the "Guiding Opinions on the Comprehensive Utilization of Bulk Solid Waste in the 14th Five Year Plan", which emphasized the promotion of comprehensive utilization and valuable gradient recovery of non-ferrous metal mineral resources, and the promotion of coordinated development between bulk solid waste and non-ferrous metal industries.

Development status: Affected by the environment, prices have risen

According to data released by the China Nonferrous Metals Industry Association, the production of ten common non-ferrous metals in China has shown an increasing trend year by year, driven by lower end demand and increased consumption, with a relatively high growth rate. The production of ten commonly used non-ferrous metals in 2022 was 67.936 million tons, an increase of 4.90% year-on-year compared to 2021.

The concentration of copper refining industry in China is relatively high, and the gap between leading enterprises is small; The concentration of electrolytic aluminum industry in China is low and the industry is relatively scattered, mainly in the early stage of the development of non-ferrous metals in China. The expansion of electrolytic aluminum production capacity was severe, the technical barriers in the industry were low, and there were many small and medium-sized enterprise participants in the industry, resulting in a scattered market concentration. In 2022, global nonferrous metal prices fluctuated greatly. In the first half of the year, copper prices continued to rise due to the Russia-Ukraine conflict, energy crisis, South American supply disturbance and other factors. In the first quarter of 2022, copper prices hit a record high. In the second quarter, prices retreated under the influence of the Federal Reserve's interest rate increase. In 2022, the annual average spot price of copper in China was 67470 yuan/ton, 1.5% lower than that of the previous year. The aluminum industry is an important basic industry of the country, and alumina and primary aluminum are important basic raw materials closely related to industries such as electromechanical, power, aerospace, shipbuilding, etc. Their product prices fluctuate periodically with macroeconomic fluctuations at home and abroad. The average annual price of aluminum spot in China in 2022 is 20006 yuan/ton, an increase of 5.6% compared to the previous year.

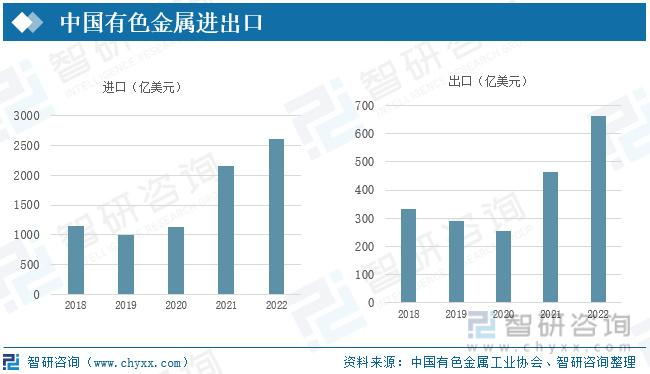

In the past two years, the growth rate of China's non-ferrous metal import and export trade has accelerated. According to customs statistics, the total import and export trade of non-ferrous metals in 2022 was 327.33 billion US dollars, an increase of 20.2% over the previous year. Before 2020, the import amount of non-ferrous metals in China fluctuated around 100 billion US dollars. In 2021, the import volume of non-ferrous metals was 215.18 billion US dollars, an increase of 89.37% year-on-year. The import value of non-ferrous metals in 2022 was 261.05 billion US dollars, an increase of 21.32% year-on-year. The export value showed a downward trend year by year before 2021, but increased significantly after 2021. In 2021, the export of non-ferrous metals was 46.45 billion US dollars, an increase of 81.1% year-on-year compared to 2020. In 2022, the export of non-ferrous metals was 66.28 billion US dollars, an increase of 42.69% year-on-year.

Related report: "Market Development Status and Competitive Landscape Forecast Report of China's Nonferrous Metals Industry from 2023 to 2029" released by Zhiyan Consulting

Enterprise pattern: fierce competition, high downstream pressure in the industry

At present, the overall characteristics of competition in China's non-ferrous metal industry are fierce competition, high downstream pressure in the industry chain, and relatively few enterprises that can participate in competition due to the monopoly of some scarce metals by the state, resulting in high barriers to entry into the industry. From the perspective of existing competitors in most segmented industries, the non-ferrous metal industry has the characteristic of strong resource utilization. A large number of non-ferrous metal enterprises are distributed in resource intensive areas. In addition, China has a large reserve of copper, aluminum and other metal resources, which also encourages a large number of enterprises that mainly engage in related non-ferrous metal processing and smelting. Representative enterprises include Zijin Mining, Aluminum Industry of China, Tongling Nonferrous Metals, Ganfeng Lithium Industry, etc.

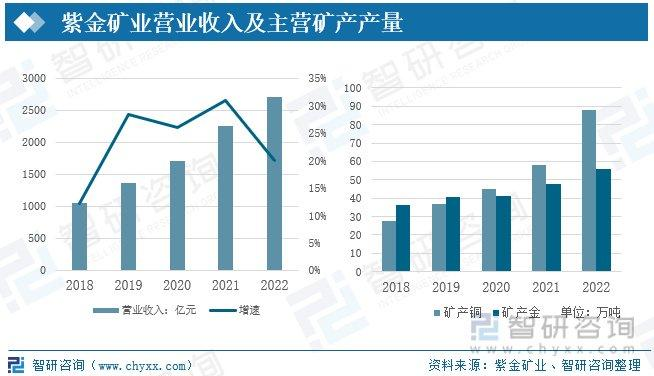

Zijin Mining is a large multinational mining group engaged in the exploration, development, engineering design, and technical application research of metal mineral resources such as copper, gold, zinc, and lithium worldwide. It is one of the enterprises in China that controls the most metal mineral resources. In recent years, Zijin Mining's operating income has maintained a high-speed growth trend. In 2022, Zijin Mining's operating income was 270.3 billion yuan, an increase of 20% compared to 2021. Before 2019, Zijin Mining's production of mineral gold was greater than its production of mineral copper. Starting from 2020, Zijin Mining began to vigorously develop mineral copper, and the production of mineral copper achieved rapid growth. In 2022, the production of mineral copper was 880000 tons, an increase of 300000 tons from 2021, a year-on-year increase of 51.72%.

China Aluminum Industry Group Co., Ltd. is the only large-scale aluminum production and operation enterprise in the Chinese aluminum industry that integrates bauxite exploration, mining, production, sales, and technology research and development of alumina, primary aluminum, and aluminum processing. It is the largest producer of alumina, primary aluminum, and aluminum processing materials in China, and the second largest producer of alumina and the third largest producer of primary aluminum in the world. In 2021, due to the rise in aluminum prices, the operating revenue of Aluminum Corporation of China achieved significant growth. The operating revenue in 2021 was 298.8 billion yuan, a year-on-year increase of 60.65%. In 2022, the operating revenue of Aluminum Corporation of China was 290.9 billion yuan, a decrease of 8 billion yuan from the previous year, a year-on-year decrease of 2.64%. Affected by the rise in aluminum prices, the production of China Aluminum's main products, alumina and electrolytic aluminum, has shown a downward trend in recent years. In 2022, the production of alumina was 13.51 million tons, a decrease of 300000 tons from the previous year, while the production of electrolytic aluminum slightly increased to 4.17 million tons, a year-on-year increase of 10.03%.

Development trend: Green and intelligent reform, promoting industrial upgrading

1. Improving traditional production models and promoting sustainable development

With the increasing awareness of environmental protection, the non-ferrous metal industry will pay more and more attention to sustainable development and environmental protection. Traditional non-ferrous metal production is often accompanied by significant energy consumption and environmental pollution, but now more and more enterprises are adopting clean production technologies to reduce energy consumption and waste emissions. For example, innovation in wastewater treatment and exhaust gas treatment technologies in electrolytic copper production can help reduce environmental impact. With the innovation of technology, it has become more feasible to recover non-ferrous metals from waste such as electronic devices and vehicles. Recycling not only helps reduce environmental burden, but also reduces dependence on raw ores. At the same time, the government has issued a series of policy supports for the development of non-ferrous metals. The support of government regulations and the improvement of consumer environmental awareness will further promote the development of sustainable mining and recycling. The non-ferrous metal industry can not only achieve economic benefits, but also take solid steps on the path of sustainable development.

2. Digital reform to improve production efficiency

Digital technology has had a huge impact in various fields, and the non-ferrous metal industry is no exception. The application of intelligent manufacturing and IoT technology can improve production efficiency, reduce production costs, and achieve precise control over the production process. Through sensors, data analysis, and other means, enterprises can achieve real-time monitoring and predictive maintenance of equipment status, improving the stability and reliability of production lines. Nonferrous metals, as important structural materials, have a wide range of applications in aerospace, automotive manufacturing, electronics industry, and other fields. With the advancement of technology, the requirements for material properties are becoming increasingly high, which has driven the research and development of new alloys and composite materials. For example, magnesium alloys have broad application prospects in the field of automobile manufacturing due to their lightweight and high-strength characteristics.

3. Strengthen international cooperation and optimize the supply chain

The non-ferrous metal industry has a high degree of internationalization, and fluctuations and policy changes in the global market can have an impact on the industry. International cooperation and supply chain optimization will help reduce risks and jointly address market challenges. Through cooperation methods such as technical exchange and resource sharing, enterprises can better adapt to market changes. At the same time, with the improvement of people's living standards, the requirements for the quality and appearance of consumer goods are constantly upgrading. This will affect the demand structure of the non-ferrous metal industry, prompting enterprises to provide higher quality, high value-added products.